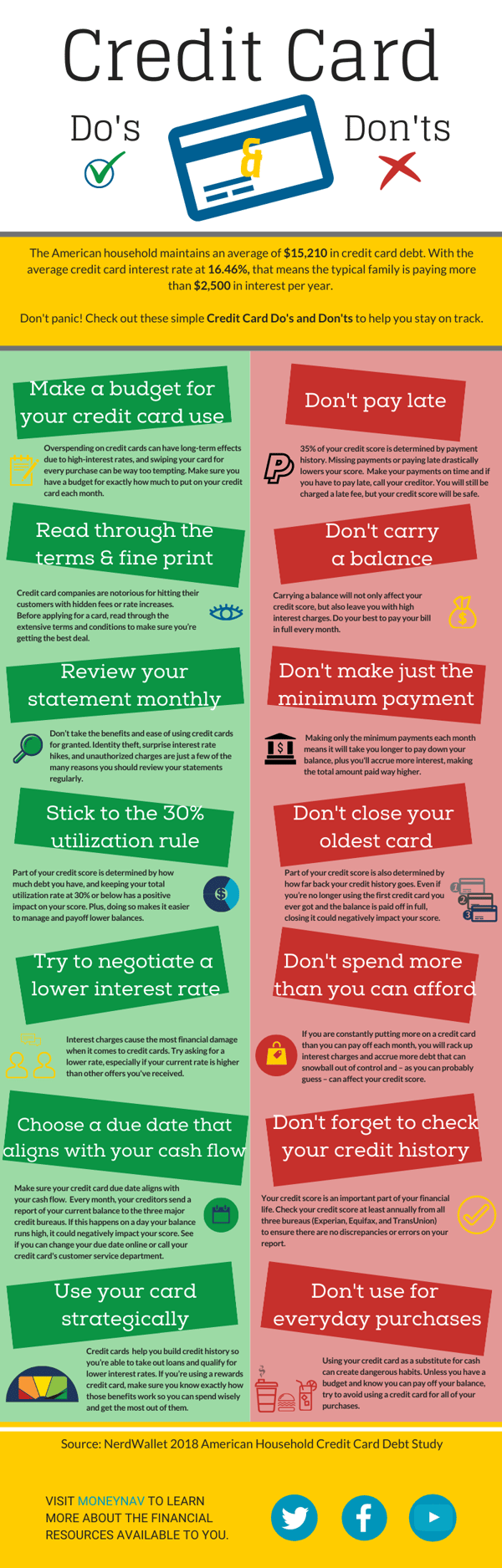

Bad credit catalogues in the UK are a popular option for individuals who may have a poor credit history but still want access to buy-now-pay-later options for shopping. These catalogues allow users to purchase items and pay for them in installments, making it a convenient alternative for those who cannot qualify for traditional credit cards or loans. However, there are dos and don’ts to keep in mind when using bad credit catalogues to avoid falling into a debt trap.

One important aspect to consider when using bad credit catalogues is the impact it can have on your credit score. While these catalogues may not require a credit check, timely payments are crucial to maintaining or improving your credit score. On the other hand, missing payments or defaulting on your account can further damage your credit rating, making it harder to obtain credit in the future. In the upcoming section, we will discuss key strategies and best practices for using Bad Credit Catalogue Reviews in UK – Bad Credit & No Credit Check responsibly to help you make the most of this financial tool.

key Takeaways

1. Only use bad credit catalogues as a last resort when traditional credit options are not available, as they often come with higher interest rates and fees.

2. Make sure to compare different bad credit catalogues to find the best deals and terms for your financial situation, as offerings can vary significantly between providers.

3. Avoid making minimum payments on bad credit catalogues, as this can lead to a never-ending cycle of debt due to high interest rates.

4. Be cautious of overspending with bad credit catalogues, as it can be easy to accumulate more debt than you can afford to repay.

5. Regularly monitor your credit score and financial situation while using bad credit catalogues, and work towards improving your credit to qualify for better financing options in the future.

The Dos and Don’ts of Using Bad Credit Catalogues in the UK

Choosing the Right Catalogue

When it comes to using bad credit catalogues in the UK, it is essential to choose the right one that suits your needs. Look for catalogues that offer flexible payment options and have a good reputation for customer service.

Understanding Interest Rates

One of the dos of using bad credit catalogues is to understand the interest rates associated with your purchases. Make sure to compare interest rates from different catalogues to ensure you are getting the best deal possible.

Managing Payments

A crucial dos of using bad credit catalogues is to manage your payments effectively. Make sure to pay your bills on time to avoid late fees and negative impact on your credit score.

Setting a Budget

To avoid falling into debt, it is important to set a budget when using bad credit catalogues in the UK. Stick to your budget and only purchase items that you can afford to pay off in a timely manner.

Avoiding Impulse Buys

One of the don’ts of using bad credit catalogues is to avoid making impulse buys. Take the time to consider whether a purchase is necessary and fits within your budget before adding it to your catalogue.

Ignoring Terms and Conditions

Another don’t of using bad credit catalogues is to ignore the terms and conditions of your agreement. Make sure to read and understand all the terms associated with your catalogue to avoid any surprises down the line.

Missing Payments

Missing payments on your bad credit catalogue can have severe consequences, such as late fees and negative impacts on your credit score. Make sure to keep track of your payment due dates and pay on time to avoid any issues.

Overextending Credit

It is crucial not to overextend your credit when using bad credit catalogues in the UK. Only borrow what you can afford to pay back to avoid falling into a cycle of debt.

Are there any other tips for using bad credit catalogues in the UK?

1. Make sure to regularly check your credit report for any errors or discrepancies.

2. Consider seeking financial advice if you are struggling to manage your catalogue payments.

3. Avoid applying for multiple catalogues at once to prevent damaging your credit score further.

Frequently Asked Questions

1. What are bad credit catalogues?

Bad credit catalogues are catalogues specifically designed for individuals with poor credit scores. They offer a way for people with bad credit to shop and make purchases on credit, often with flexible payment options.

2. How can I improve my credit score while using bad credit catalogues?

To improve your credit score while using bad credit catalogues, make sure to make your payments on time and in full. This will show that you are a responsible borrower, which can help improve your credit over time.

3. What are some dos of using bad credit catalogues?

Some dos of using bad credit catalogues include sticking to your budget, making payments on time, and checking for hidden fees or high interest rates before making a purchase.

4. What are some don’ts of using bad credit catalogues?

Some don’ts of using bad credit catalogues include overspending, missing payments, and ignoring the terms and conditions of your catalogue account. These can all negatively impact your credit score.

5. Can using bad credit catalogues help me rebuild my credit?

Yes, using bad credit catalogues responsibly can help you rebuild your credit over time. By making timely payments and managing your account properly, you can demonstrate that you are a reliable borrower.

6. Are there any alternatives to using bad credit catalogues?

Yes, there are alternative options for individuals with poor credit, such as secured credit cards, credit builder loans, or prepaid cards. These can also help you manage your credit and improve your score.

7. Can I shop for a variety of products using bad credit catalogues?

Yes, many bad credit catalogues offer a wide range of products, from clothing and electronics to furniture and appliances. You can find almost anything you need through these catalogues.

8. How can I avoid falling into debt while using bad credit catalogues?

To avoid falling into debt while using bad credit catalogues, make sure to only buy what you can afford and prioritize paying off your balance each month. Avoid spending beyond your means to prevent accumulating debt.

9. Can I return products purchased through bad credit catalogues?

Yes, most bad credit catalogues have a return policy in place that allows you to return products within a certain timeframe if you are not satisfied with your purchase. Make sure to familiarize yourself with the return policy before making a purchase.

10. How can I find reputable bad credit catalogues to use in the UK?

You can find reputable bad credit catalogues in the UK by reading reviews, checking for accreditations, and researching the catalogue’s reputation online. Look for catalogues that offer transparent terms and fair pricing.

Final Thoughts

When it comes to using bad credit catalogues in the UK, it’s important to approach them with caution and responsibility. While they can provide a convenient way to shop on credit, they can also lead to debt if not managed properly. By following the dos and don’ts of using bad credit catalogues, you can make the most of these services while also improving your credit score over time.

Remember to always prioritize making timely payments, sticking to your budget, and avoiding unnecessary purchases. With the right mindset and strategies in place, bad credit catalogues can be a valuable tool for rebuilding your credit and achieving your financial goals.