Catalogues, with their enticing buy now, pay later offers, have become a popular shopping option for many consumers. While they offer convenience and flexibility, using credit through catalogues can have significant implications for your credit score. In this blog post, we will explore the pros and cons of using credit for shopping through catalogues and its impact on credit scores. By understanding these factors, you can make informed decisions about using credit through catalogues and its potential effects on your credit health.

Understanding Catalogues and Credit Shopping

Catalogues have evolved from simple mail-order catalogues to digital platforms that offer a wide array of products. They allow customers to shop from the comfort of their homes, browsing through various categories and selecting items of interest. One appealing aspect of catalogues is their credit shopping feature, where customers can buy now and pay later, either in full or through installments. This credit aspect makes catalogues an attractive option, especially for those who may not have access to traditional credit sources.

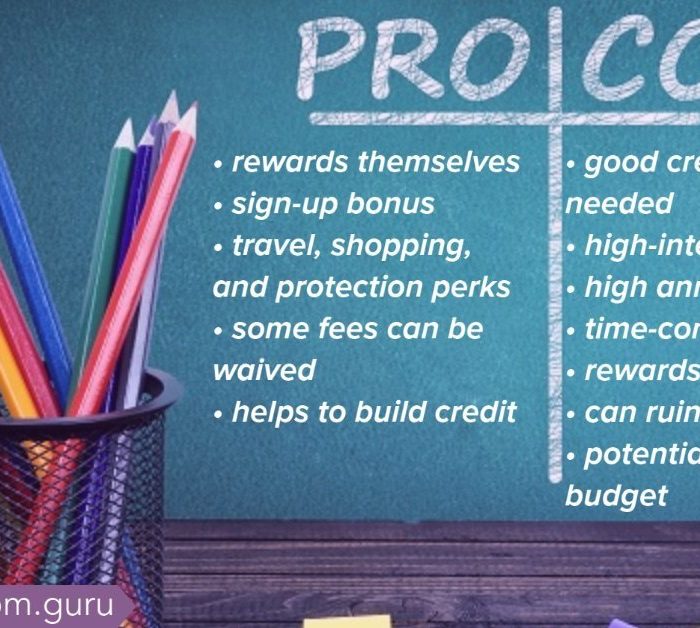

The Pros of Using Catalogues for Shopping

Convenience and Accessibility: Catalogues offer unparalleled convenience, allowing customers to shop online or by phone without leaving their homes. Additionally, they provide access to credit for individuals with limited credit history or poor credit scores, making them more inclusive compared to traditional credit sources.

Flexible Repayment Options: Catalogues typically offer various repayment options, including installment plans. This flexibility allows customers to manage their budgets better and pay for purchases over time rather than all at once.

Diverse Product Selection: Catalogues offer a wide range of products, from clothing and electronics to home goods and furniture. This diverse selection caters to various consumer needs, providing an extensive shopping experience.

The Impact on Credit Scores: Positive Aspects

Responsible Credit Usage: Using credit through catalogues responsibly can positively impact credit scores. Making timely payments and managing credit responsibly demonstrates creditworthiness to potential lenders.

Building Credit Mix: Catalogues can contribute to building a diverse credit mix, which is beneficial for credit scores. A healthy mix of credit types, such as credit cards, loans, and retail accounts, demonstrates your ability to handle different forms of credit.

Credit Access for Limited Credit History: For individuals with limited or no credit history, catalogues can serve as a stepping stone to establish credit. Responsibly managing a catalogue account can help build a positive credit history.

The Cons of Using Catalogues for Shopping

Higher Interest Rates: One significant drawback of using credit through catalogues is the higher interest rates compared to traditional credit cards or loans. These rates can lead to increased borrowing costs if balances are not paid off promptly.

Overspending and Debt Accumulation: Credit shopping through catalogues can tempt consumers to overspend beyond their means, leading to debt accumulation. Without careful budgeting, this debt can quickly become unmanageable.

The Impact on Credit Scores: Negative Aspects

Late Payments: Late payments on catalogue accounts can have a detrimental impact on credit scores. Timely payment history is a critical factor in credit scores, and missed payments can result in lower scores.

High Credit Utilization: Using a significant portion of the credit limit on a catalogue account can negatively affect credit scores. High credit utilization signals potential credit risk to lenders.

Multiple Open Catalogue Accounts: Opening multiple catalogue accounts within a short period can lead to a higher risk perception among lenders, potentially lowering credit scores.

Responsible Credit Shopping with Catalogues

Using credit through catalogues can be a useful tool when done responsibly. To minimize negative impacts on credit scores, consider the following tips:

Create a Budget: Before making purchases through catalogues, create a budget that aligns with your financial capabilities. Stick to this budget to avoid overspending.

Make Timely Payments: Pay your catalogue bills on time to establish a positive payment history and boost your credit score.

Avoid Excessive Credit Utilization: Keep your credit utilization ratio low by using only a small portion of your available credit limit.

Alternative Credit-Building Options

For those looking to build or rebuild credit without using catalogues, alternative credit-building options are available:

Secured Credit Cards: Secured credit cards require a security deposit and can help establish or rebuild credit when used responsibly.

Credit-Builder Loans: Credit-builder loans are designed specifically to improve credit scores and establish credit history.

Monitoring Credit Scores and Credit Reports

Regularly monitoring your credit scores and credit reports is crucial for understanding your credit health and identifying areas for improvement. Many online services offer free credit report access and credit monitoring tools.

Making Informed Decisions for Credit Shopping

Before using credit through catalogues, weigh the pros and cons and consider the impact on your credit scores. Responsible credit management is vital for long-term financial well-being.

Conclusion

Using credit through catalogues for shopping can be convenient and accessible, but it comes with both pros and cons that can impact credit scores. Responsible credit usage and timely payments can positively affect credit ratings, while overspending and late payments can lead to negative consequences. It’s essential to make informed decisions about using credit through catalogues and consider alternative credit-building options when necessary. By managing credit responsibly and monitoring credit health, you can navigate the world of catalogues and credit scores to achieve a stronger financial future.